Elevate your APC score with our credit card!

Timely payments boost your score and increase your limit. Simple steps for greater financial health and more spending power.

Start improving your credit journey now!

Boost your credit card approval chances

Simple steps for a stronger financial profile:

Mejora la aprobación de tu tarjeta de crédito

¡Pasos sencillos para un perfil financiero más sólido!

Boost your credit card approval chances

Simple steps for a stronger financial profile:

1

2

3

1

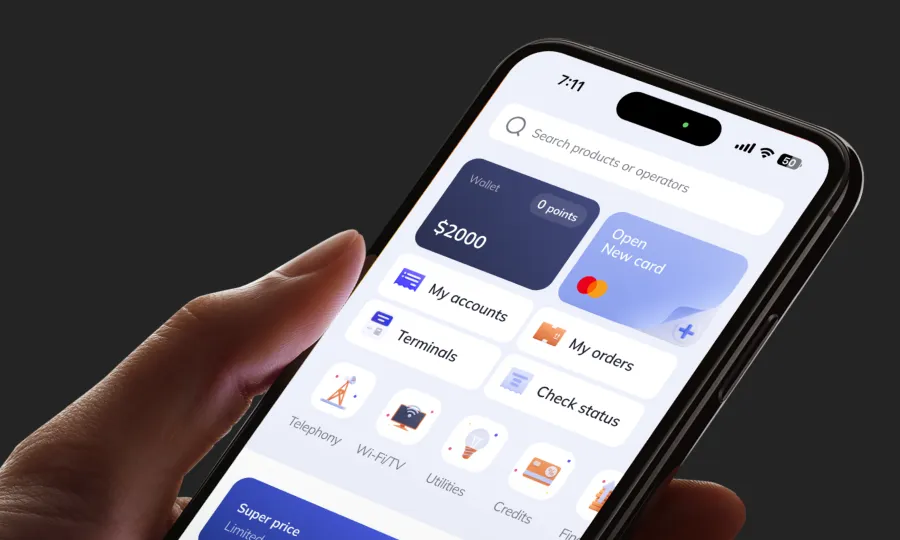

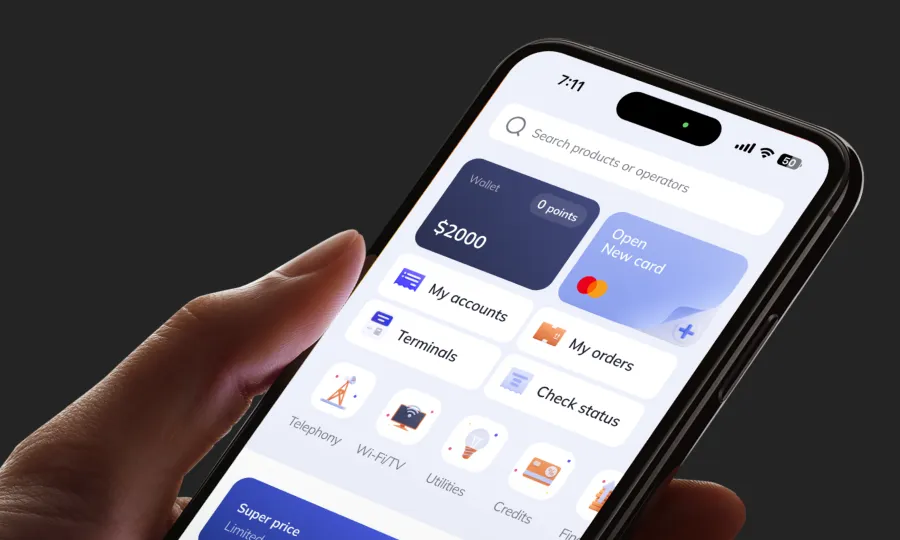

Use Your Debit Card

Use your Punto Pago debit card daily and pay bills in the Punto Pago app

2

Apply for a Credit Card

Apply for a Punto Pago credit card in the app

and start using it

3

Improve Your APC Credit Score

and Increase Your Credit Limit

Use your credit card and pay it back on time to improve your Panamanian APC credit score and secure a higher limit for your Punto Pago credit card

No commission and hidden fees

Typical credit cards in Panama:

Punto Pago

Annual Fees

$0

Foreign Transactions

0%

Card Insurance

$0

ATM Fees

$0.99 fixed fee

Late Payments

$0.50-$5

Others

Annual Fees

$20-$200+

Foreign Transactions

~3%

Card Insurance

Extra

ATM Fees

5% + fixed fee

Late Payments

$20-$60

Switch to Punto Pago for fee-free banking. Save more, enjoy more.

Pay on time to reduce your interest rate and increase your limit

Every 3 months, we review your loan's interest rate

if payments are timely